Silicon Valley’s AI Gold Rush: Billionaires Cash Out $16B as Stocks Skyrocket

As tech stocks soared to record highs on the AI boom, Silicon Valley’s elite hit the exits—turning paper fortunes into cold hard cash. In 2025, tech billionaires cashed out over $16 billion through pre-arranged insider trading plans, leveraging AI-driven stock surges to convert equity into liquidity.

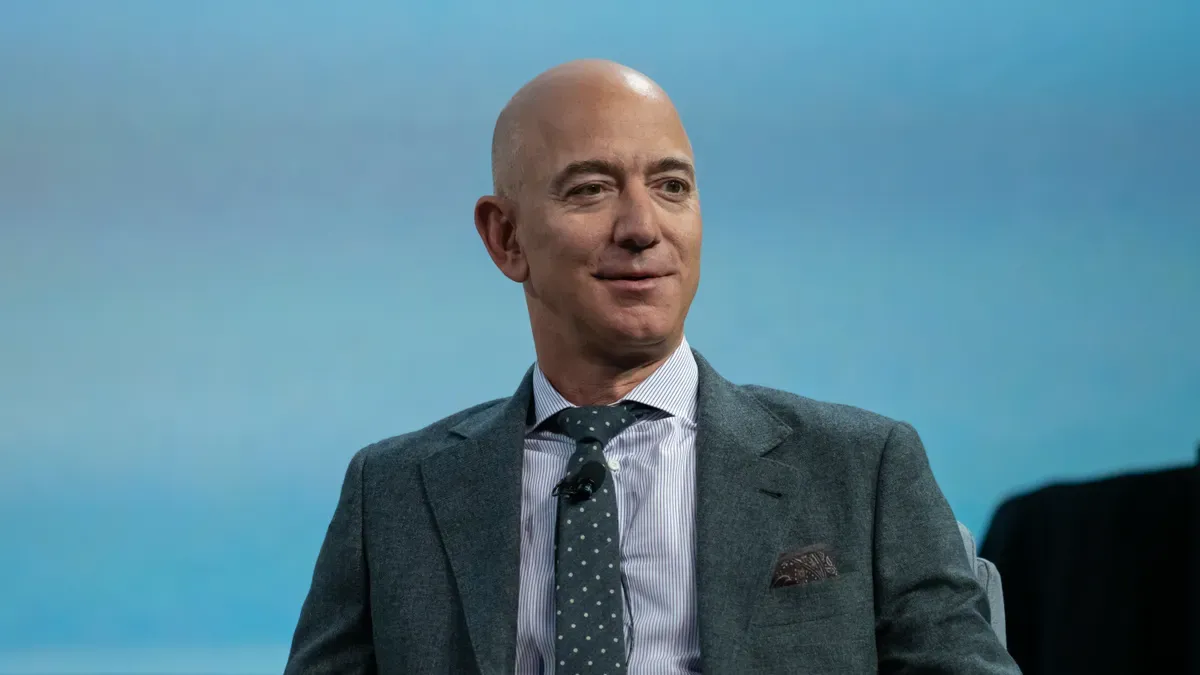

Jeff Bezos sold $5.7 billion in Amazon shares around his Venice wedding, while Nvidia’s Jensen Huang cashed out $1 billion as the company became the first $5 trillion business.

Mark Zuckerberg liquidated $945 million through his foundation, and Palo Alto Networks CEO Nikesh Arora and Robinhood founder Baiju Bhatt each secured $700 million+. Seventy-five percent of these transactions occurred via scheduled trading windows, normalizing the practice as a wealth management strategy amid AI-fueled stock valuations.

Companies like NVIDIA and Arista Networks saw peak demand during this period, with executives capitalizing on market momentum. The structured nature of these sales—rooted in pre-disclosed plans—contrasts with the speculative frenzy of the AI gold rush, highlighting how Silicon Valley’s top earners balance innovation with financial pragmatism.