General Fusion’s $1 Billion Bet: Can Fusion Power Survive the Hype?

From near-bankruptcy to a $1 billion valuation: General Fusion’s fusion gamble is back on the table.

General Fusion, a fusion power startup, plans to go public via a $335 million reverse merger with Spring Valley III, valuing the combined company at $1 billion. The company previously faced financial struggles, laying off 25% of its staff and securing a $22 million lifeline in 2023.

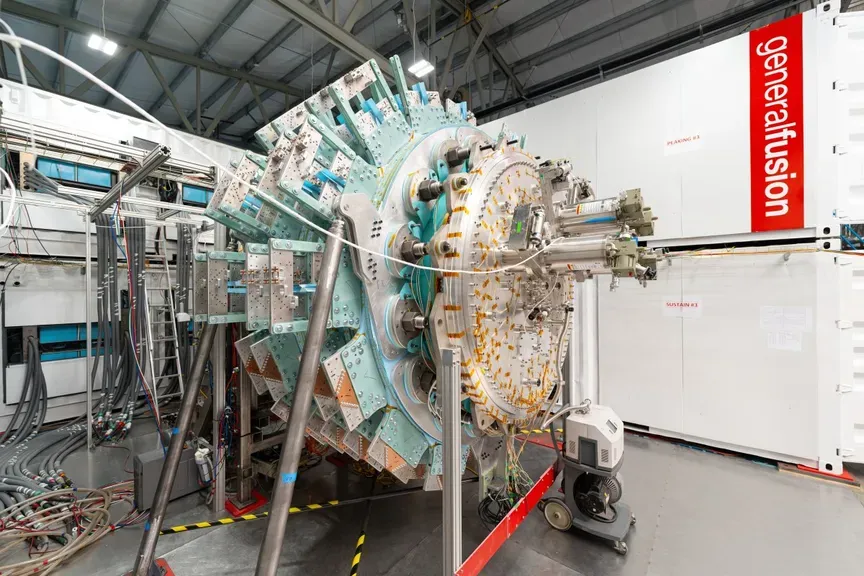

Its Lawson Machine 26 (LM26) reactor uses steam-driven pistons and liquid lithium to achieve inertial confinement fusion, avoiding expensive lasers or superconducting magnets. The startup aims to reach scientific breakeven by 2026, where fusion reactions generate more power than required to initiate them, though commercial viability remains unproven.

Spring Valley III has a mixed track record in energy SPACs, with NuScale Power’s stock dropping over 50% post-merger. General Fusion joins TAE Technologies (valued at $6 billion) in pursuing public funding, citing rising energy demand from data centers and electrification trends.

BloombergNEF projects global energy demand will grow by 50% by 2050, but critics argue piston-driven fusion faces unresolved scaling challenges compared to laser-based approaches like those at NIF or private firms such as Helion Energy.